Title Insurance: What, Why and Who?

Attorney Roger H. Miller III

Roger is Board Certified by The Florida Bar in Real Estate and focuses his legal practice on civil litigation and real estate.

What is title insurance?

Title insurance ensures that a buyer in a real estate transaction receives clear title to the property subject to only those exceptions which are excluded from the title insurance policy. Prior to closing, a title insurance commitment is typically issued and delivered to the buyer. The buyer then has a certain time period specified in the contract to review the title commitment and object to anything that renders title unmarketable. The title commitment includes the names of the buyer, seller, and any lender, as well as the legal description of the property being insured. The title commitment includes both requirements on the part of the closing agent in order to issue the title insurance, as well as exceptions to the title insurance coverage. Not all exceptions to the title insurance coverage are bad. Certain exceptions, such as a utility easement, may actually benefit the property by allowing for utilities. Depending on your perspective, recorded restrictions could be either a benefit by preserving the aesthetic character of a neighborhood, and a burden, by restricting the characteristics of your house, what you can park in the driveway, etc. The title commitment, along with a survey, is essential in confirming both clear title and what you may or may not do on your property. The nature and location of any exceptions should be carefully examined to confirm they do not interfere with the buyer’s intended use. For this reason, title insurance commitments should be scrutinized and any objections to title should be made in accordance with the timeframes specified in the contract. After closing, a title insurance policy is issued to the buyer. If something arises after closing that is covered by title insurance, the title insurance underwriter has a duty to resolve the issue or pay the value of the title defect, up to the policy limits.

Why do I need title insurance?

Title insurance is a standard requirement in most form real estate contracts. Title insurance is also required by lenders in financed real estate transactions. In a cash deal, you are not required to have title insurance, but for the reasons set forth above, it is certainly recommended. The relative cost of title insurance ($575 on a $100,000 policy) is inexpensive compared with losing your home or other real estate investment.

Who pays for it?

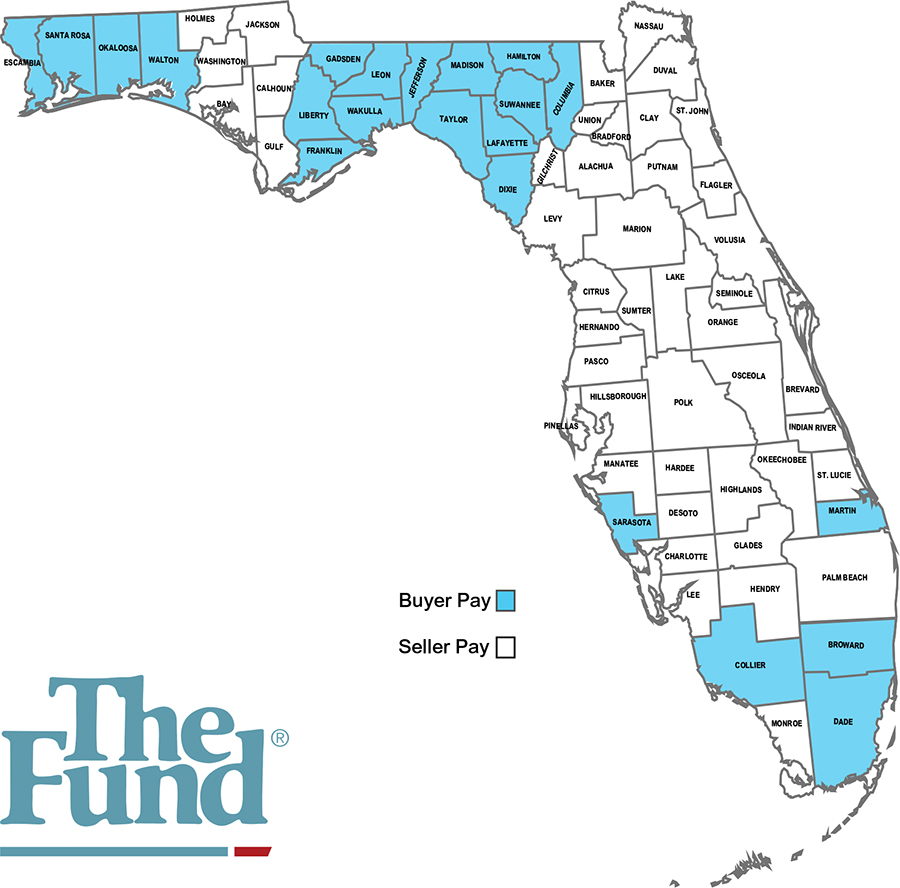

Map provided by The Fund®

Concept | September 2015 | Vol 47 | Florida Edition

A lawyer’s favorite mantra is: “that depends.” The custom in the majority of counties in Florida (44/67) is that seller pays for title insurance. Monroe County survey respondents reported that Islamorada and the Upper Keys follow the custom of the counties to the north where the buyer pays; whereas Marathon and the Middle Keys were reportedly seller-pay areas. Key West and the Lower Keys were a combination of seller-pay and buyer-pay. Even in Charlotte County, where the custom is seller pays, portions of Manasota Key, even on the Charlotte County side, and Boca Grande seem to follow the Sarasota custom, where buyer pays. This discrepancy is likely the product of real estate agents that work primarily in Sarasota being used to the buyer paying and drafting contracts in that fashion.

In conclusion, title insurance is an important, and in some cases, indispensable aspect of a real estate transaction. Parties to real estate transactions, especially those not versed in reviewing title insurance commitments, surveys and title documents, should seek the advice of a real estate attorney.